Top 100 Best Blue Chip Stocks India To Buy In 2023 : Best Companies In India To Invest | caraacara

Permission from Abraham Lincoln’s son to use the former president’s name was granted. In 1969, Lincoln National Corp begins trading on the New York Stock Exchange and the Midwest Stock Exchange. Blue chip companies operate profitably despite adverse economic conditions, which helps to contribute to their long records of stable and reliable growth.

Texas Instruments is the world’s largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications. Lockheed Martin is the largest defense contractor globally and has dominated the Western market for high-end fighter aircraft since the F-35 program was awarded in 2001.

According to Deloitte, electric car sales are likely to grow at a CAGR of 29% through 2030. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Since Visa makes its money on transaction fees, the company performs well when spending rises. That’s a good thing, since the economy generally grows more than it contracts.

For those investors blue chip stocks can be a viable alternative. Having a few of these stocks in your portfolio, even if they occupy a very small percentage, can help offset the gut-churning volatility that can affect every investor’s actual risk tolerance. The first reason to like Chevron is an investment grade balance sheet. With the company’s assets having an attractive break-even, the cash flows are robust. While blue chip companies are reliable, that also comes with slower growth. This makes them a conservative option for investors looking for a safe bet for their already established portfolio.

They represent the crème de la crème of equities — the biggest, richest companies. Microsoft returned $10.9 billion to shareholders in Q through dividends and share repurchase. Considering the cash flows and the balance sheet health, aggressive repurchasing should continue.

Blue chips are characterized by a high credit rating, large market capitalization, a listing on the NYSE or another major stock exchange, and are often listed in a major stock market index. In sports, a blue-chip prospect is thought to be a can’t-miss talent — someone who will excel at the game no matter what obstacles are thrown. Blue chips are safe bets with high floors and potentially limitless ceilings. When investors buy blue chip stocks, they want proven track records and promises of future success. And while investing in stocks is never a completely safe bet, blue chips are often stocks with the best risk/reward trade-off. If you want to add blue chip stocks to your portfolio, here are some very successful stocks with staying power.

Contributing Author: Technical and Fundamental Analysis

Moreover, a portfolio’s allocation to stocks can be diversified among large-caps, mid-caps and small-caps, as well as domestic and international stocks. The term “blue chip” was first used in 1923 by https://1investing.in/ Oliver Gingold, an employee of Dow Jones, to describe stocks that traded at $200 or more per share. It relates to poker chips of blue, white, and red, with the blue chips having the greatest value.

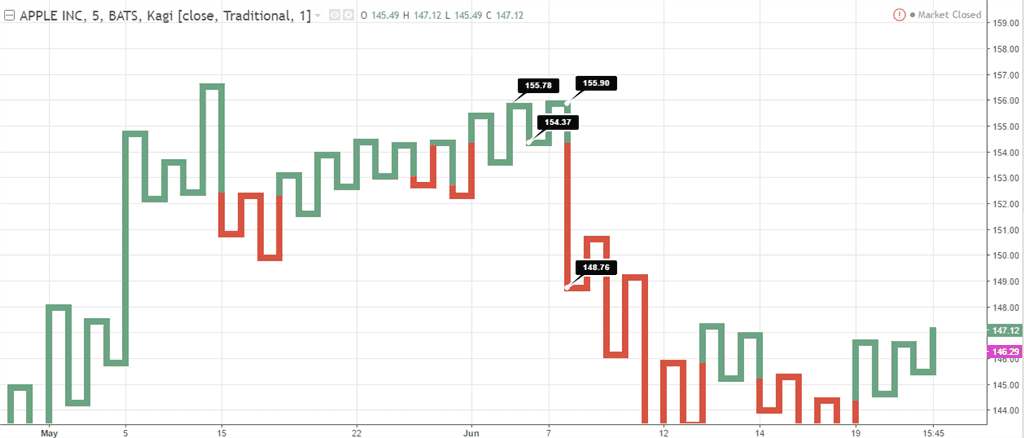

Apple’s current valuation is due to the fact that the stock has gained more than 30% year-to-date. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. Enter your email address below to receive the latest headlines and analysts’ recommendations for your stocks with our free daily email newsletter.

- You can also buy a fund that tracks the S&P 500 or the Dow Jones Industrial Average since both include blue-chip stocks.

- Yet, they’re not immune to market downturns and economic upheaval.

- These large-cap stocks often have a market valuation of $10 billion or more.

- For the fourth quarter of 2021, the company reported revenue growth of 29% to $83.4 billion.

Advertising never stops, and they’re often a part of our daily lives. Johnson & Johnson’s stock has been one of the stock market’s longest-term winners since going public in the 1960s. The Tylenol murders of the 1980s gained national headlines and the perpetrators were never caught. The State of New York also recently filed a $2 billion lawsuit against the drug manufacturer on the grounds that they downplayed the risks of opioids and spent millions marketing them as safe. Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation.

S&P 500

UNH is also leveraging technology to improve outcomes and lower costs. Procter & Gamble makes essential household products, things like shampoo, razors, toothpaste, diapers and toilet paper. That line-up of necessities insulates PG from downturns–since people keep buying diapers and toilet paper even when times are tough. Gains that come purely from stock price increases, on the other hand, can be elusive. Those gains aren’t definitively yours until you liquidate the position. Johnson & Johnson (JNJ 0.03%) is well-known for its popular consumer products, including baby shampoo, Band-Aids, and Tylenol pain reliever.

Investing in blue-chip stocks is a great way to build a portfolio. However, not all blue-chip stocks are suitable for all investors at all times. Build a watchlist of blue-chip stocks first, then pick the right ones and buy them when they present the best opportunities. Over time, you can build a large portfolio of dividend-paying blue-chip stocks to sustain a comfortable retirement. Investors with a high risk tolerance may choose to invest in small-cap or mid cap companies.

In other cases, the funds or ETFs might be focused exclusively on blue chips, such as an ETF that tracks the Dow Jones Industrial Average (which comprises 30 of the largest blue chip stocks). A blue chip stock is stock issued by a large, well-established, financially-sound company with an excellent reputation. Normally, such companies have operated for many years, have dependable earnings, and usually pay dividends to investors. The company has a strong financial performance and a track record of stable earnings and revenue growth. The Morningstar Style Box, meanwhile, is a nine-square grid that provides a graphical representation of the investment style of stocks, bonds, or funds.

Which is the best blue chip company in India?

Hello, I am Raj an investor in Stock Market, Mutual Funds, Gold, PPF, FD instruments since 2005. I have a passion for helping others make sound and profitable investment decisions. Though the restaurant industry generally suffers steep declines during recessions, McDonald’s has shown remarkable resilience. The stock rose 8.55% in 2008 amidst the Great Recession and grew 11.3% despite COVID-induced lockdowns in 2020.

That and the fact that they have weathered multiple downturns in the economy make them stable companies to have in a portfolio. AMZN stock has been another underperforming name among blue-chip stocks in 2021. However, there is no doubt that the stock is likely to remain in a long-term uptrend. An important point to note is that for 2021, Pfizer expects revenue of $33.5 billion from the Covid-19 vaccine. The company expects to deliver 2.1 billion doses of the vaccine through the year.

- Johnson & Johnson manufactures many of the popular medicine brands we use for common aches and pains, like Tylenol, Benadryl, Sudafed and Neosporin.

- The company generates ample cash to fund its dividend and growth initiatives.

- Their large businesses typically have many years, if not decades, of successful operations to back up the valuation.

- Explore the world of large-cap stocks and learn how these can shape your portfolio.

Over the years, a blue chip company will have survived financial challenges and difficult market cycles. It will have turned in a steady return and typically paid dividends year in and year out. The security of blue chips ranks at the top of their appeal to investors. Blue chips’ history of weathering even the stormiest of times puts them in a kind of safe-haven category. This gives investors comfort in knowing these stocks emerge less scathed than their counterparts in rocky times. Just as blue chips in poker hold the highest value, so do blue-chip stocks in the stock market.

Blue chips in a well-balanced portfolio

And when investors turn to the financial press, they find that analysts and advisors will offer different opinions. The truth is that over the years, there’s a case to be made for both. The bank has a strong management team and a consistent track record of dividend payouts. The company has paid dividends since 1965 and raised its payout annually over the last 52 years, marking PepsiCo as a dividend king. PepsiCo holds leading positions across its portfolio, owns coveted retail shelf space, boasts unmatched distribution scale, and invests aggressively in advertising and product innovation. The addition of the Company Store brought textile exposure to Home Depot’s lineup.

For the current year, the company is on-track to deliver $75 billion in global ecommerce sales. In the near term, sales of the iPhone 13 are likely to ensure that growth remains loan sharks robust. At the same time, Apple is looking for further diversification with a cash glut. A rumored entry into the electric vehicle segment is also an impending catalyst.

7 Best Blue Chip Stocks to Buy Now – MarketBeat

7 Best Blue Chip Stocks to Buy Now.

Posted: Fri, 08 Sep 2023 13:45:31 GMT [source]

While there is no formal definition of a blue-chip stock, these companies are known for being valuable, stable and established. They’re typically big names — often household names — in their industries, and investors count on them for their reliability. Blue chip stocks are stocks of large, well-known, and widely respected companies. Most of these companies pay dividends and have many decades of profitable operation under their belts. Alternatively, blue chip ETFs can offer a narrower concentration of high-quality stocks than an S&P 500-tracking ETF or a Nasdaq-tracking ETF. Financial giant American Express (AXP 0.85%) is another blue chip stalwart to consider.

More From InvestorPlace

For that reason, they are often sought after and considered low-risk investments. Today, blue chip stocks aren’t necessarily stocks with a high price tag. More accurately, they are shares of high-quality companies in healthy financial condition that have withstood the tests of time.

CEO Warren Buffett has one of the most impressive track records of market-beating returns in history and prefers investing the company’s cash in lieu of paying dividends. Investors can add new stocks they find or become interested in and also cut out any that don’t maximize the portfolios’ goals. What makes the right blue chip stocks depends on the investor, the goal of the portfolio and the allocation targets for holdings. A $1,200 stock may be attractive for many reasons, but the price is so high it may be a problematic fit for smaller portfolios. At face value, a single share is worth more than 10% of a $10,000 account and may expose it to undue risk. Blue-chip stocks occupy the most respected level of the stock market.

However, there is constant shareholder value creation through dividends and share repurchase. We see limited downside in the stock’s price, as inventory correction has already been priced in, he adds. He also notes that TSMC has generated more stable earnings than many of its peers, which has led to more consistent (and growing) dividends over time.

These companies have strong fundamentals that make them some of the highest value stocks. For example, many companies have pricing power means that allows them to pass along increased producer costs to the consumer. This means that the companies are more likely to retain their operating margins, which will typically translate to more stable earnings.

The acquisition will help the company accelerate its cloud strategy for healthcare. With a strong cash buffer, it’s likely that Microsoft will continue to pursue acquisitions to drive growth. An important note is that Apple has continued to deliver strong numbers.

If you’re looking for dividend payouts and steady growth, blue chip stocks are perfect for your portfolio. Investors can also buy mutual funds and ETFs that specifically target blue chip companies, giving them exposure to an entire basket of blue chip stocks with a single investment. Most asset managers, including Fidelity and BlackRock, offer one or more blue chip-focused funds.

Even the most aggressive investor needs to have 30% to 50% exposure to blue-chip stocks. This is particularly true in a global economy with multiple uncertainties. UnitedHealth Group is one of the largest private health insurers, providing medical benefits to 50 million members globally, including 5 million outside the U.S. at the end of 2021. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care.