Most Accurate Intraday Trading Indicators | caraacara

Contents:

Experienced traders know how to turn a high probability trade into short-term profits, regardless of whether the market is moving up or down. The ability to make money in any market is one of the most significant benefits of CFD and Forex trading. While Fundamental analysis is not chart based, it is essential to understand how to read charts to confirm that the trade is going in the direction expected. In the case below, the chart shows that the trader would have made 100 pips of profit in 5 minutes, and should they have kept the trade open longer, they would have made 200 pips of profit. Having held the trade open a little longer would have been a more profitable trade. The analysis and discussion provided on Moneymunch is intended for educational and entertainment purposes only and should not be relied upon for trading decisions.

This is one of those indicators that tell the force that is driving in the forex market. In addition, this indicator helps identify when the market will stop in a particular direction and will go for a correction. The absolute value of the biggest of the three ranges is called the true range. However, the average true range is the moving average of specific true range values. Bollinger bands come in three parts, the upper, middle, and lower brands. These bands are often used to determine overbought and oversold conditions.

- He developed his own proprietary indicators that analysed price elements such as trend, momentum and volume.

- It can be measured using various investing software programs and websites.

- One can use any of the indicators based on their backtest and comfort.

- The slow stochastic oscillator compares two lines called the %K and %D lines to predict the possibility of an uptrend or a downtrend.

In price charts, the %K line typically appears as a solid line, and the %D line appears as a dotted line. The slow stochastic oscillator can be used effectively to monitor daily, weekly or monthly periods. The Momentum Indicator is a speed of movement indicator to identify the speed of price movement. The momentum indicator compares recent closing price to a previous closing price. These will help you to make educated decisions and maximize your profit potential. It is the concept of momentum indicator that is very advantageous as a means of authorisation of a breakout reversal.

Free Stock, Commodity, Forex Trading Tips & Education Articles

Also, Momentum can be used as a trend indicator when it crosses the zero line down; you need to sell, buy up. The 90/10 Rule signifies the importance of trade management techniques. 90% rule states that the trader’s major action is to manage the trade and keep it from hitting stop loss. Correlation is a statistical measure of two variables and how they relate to one another. In the Forex market, the currencies are compared, priced, and analyzed in pairs of two, which makes their correlation a significant phenomenon. As you can see in the above image, the red lines that run through the middle of the chart represent the Donchian Channel area that is the median of the upper and lower bands.

The RSI ranges from 0 to 100, with higher values representing overbought conditions and lower values indicating an oversold position. A value near zero indicates that the security has been moving sideways for some time. An investor may use this information as part of his/her decision-making process when trading securities.

A guide to momentum trading and indicators – FOREX.com

A guide to momentum trading and indicators.

Posted: Thu, 16 Mar 2023 07:00:00 GMT [source]

When the %K line nears the 100% or 0% line a powerful move is set to occur. Some technical analysts equate the extremes with overbought or oversold conditions, and that prices cannot get any higher or lower. However, Edwards and Magee identify that this is not true in all situations, and that the extremes instead represent the strength of a price move. According to Martin J. Pring, George Lane developed the stochastic oscillator with the premise that during an uptrend, the closing price tends to rise. However, when the uptrend matures, price tends to close towards the bottom of the price range for the period. The slow stochastic oscillator compares two lines called the %K and %D lines to predict the possibility of an uptrend or a downtrend.

Types of Momentum Indicators

Traders have options of how long to keep the trade open for, as this will affect profitability. Each method has advantages and disadvantages where the distinct differences between the two approaches dictated how traders approach their analysis. Financial instrument is considered to be oversold when its RSI falls below 30 and overbought when its RSI rises over 70.

He developed his own proprietary indicators that analysed price elements such as trend, momentum and volume. So popular are his indicators that MT4 has a dedicated tab to access them. Bill Williams indicators include Alligator, Accelerator Oscillator, Awesome Oscillator, Fractals, Gator Oscillator and the Market Facilitation Index . Bill Williams indicators are very comprehensive such that they can be utilised by themselves exclusively. Common among more advanced traders, market cycles indicators attempt to efficiently track the ebb and flow of price changes.

way to open an account!

As the name suggests, trend indicators are designed to help traders to identify and take advantage of opportunities in trending markets. Traders who use trend indicators want to establish the dominant trend in the market, as well as the optimal price points to join the trend, ride it and finally, exit. The idea is to always place trades that are in tandem with strong trends. Trend reversals are confirmed when there is a moving average crossover. For instance, in an uptrend, the end of the trend and a possible reversal is signalled when the faster moving average crosses the slower one downwards. The stochastic oscillator can be used as an alternative to other momentum indicators such as moving averages.

The conventional buy or put possibility signals for the moving average ribbon are the same as the crossover signals used with other MA strategies. Since there are numerous crossovers involved, a trader must choose the number of crossovers that constitute as good trading indicators. To best employ an envelop strategy, a trader should test out different percentages, time intervals, and currency pairs. Ideally, a trader must buy when there is a significant directional bias to the price. Similarly, to exit a market the trading indicators must indicate that the price has moved to the lower band for a short trade and upper band for a long trade. Elliot wave technical indicator helps in determining where an Elliott wave ends and a new one begins.

Forex Signals Brief April 26: Inflation Continues Slowing Trend in … – FX Leaders

Forex Signals Brief April 26: Inflation Continues Slowing Trend in ….

Posted: Wed, 26 Apr 2023 08:22:21 GMT [source]

Many traders use the Bollinger Bands technical analysis to get relatively clear buying and selling signals on steady ranges of security such as currency pairs. Sometimes it is possible to have reactions that are not as intense, and that can make the traders can miss profits if the orders are set directly on the upper and lower Bands. The momentum indicator isn’t going to give a trader much information over and above what can be seen just by looking at the price chart itself.

Popular In Markets

The rate of change is the speed at which the price changes over time. This indicator is expressed as a ratio between a change in one variable relative to the change in another. The buy and sell signals are also generated by MACD by bullish and bearish divergences. A common excuse people have for not learning how to do technical analysis is the notion that you need to spend all day in front of the computer to be successful. The advantage of technical trading is the ability to make good consistent gains in any market without feeling like you have a second job. Fundamental analysis is studying the economics of a country, new media, macroeconomic trends, where the trader examines the underlying economic conditions of a currency.

Hidden divergence is not followed by a significant change in trend and this is an indicator of continuation as you can find in the image below. One can use any of the indicators based on their backtest and comfort. Apart from selecting the indicator, a trader can tweak the parameters to suit his comfort zone. This code evaluates this by looking at two consecutive bars or sets of bars.

An “up” close or a “down” close is defined as the absolute change in price from close to close. The interpretation of the Momentum indicator is identical to the interpretation of the Price ROC. Both indicators display the rate-of-change of a security’s price. However, the Price ROC indicator displays the rate-of-change as a percentage whereas the Momentum indicator displays the rate-of-change as a ratio.

The forex market is a volatile one and is affected by multiple factors on a daily basis. By understanding the correlation between currencies, these risks can be reduced, and that gives the traders a better shot at making profits. Below you can see charts of buying at bullish and selling at the bearish trendline. A market rejection from the Parabolic Stop and Reverse indicator is a potential entry point for the traders. The increase and decrease of volatility in financial markets indicate the market reversal and continuity respectively.

The market has been on a steady decline for over 6 months beginning at the bearish crossover of the 100-level reference point in June. Since then, EURUSD have remained strongly bearish and the Momentum Indicator have also produced 3 other strong bearish crossover signals. If the Momentum Indicator reads below 100 level reference point, it means the market directional bias or momentum is bearish. If the Momentum Indicator reads above the 100 level reference point, it means the market directional bias or momentum is bullish. Momentum oscillators measure the magnitude of change in a share’s price over a specified timeframe.

This indicates that while the price is rising, the momentum behind the buying is slowing and the trend may reverse to the downside. Here is an example of how the release of positive NFP (non-farm payroll) reports can affect the market. Should a trader expect this report to show robust job creation, we open a trade before the report is released and go long. EURUSD Analysis – Know the history of the pairs you trade, as you will see the same seasonal trends and repeat performances.

Top 5 Momentum Indicators that Analyses Trend Strength

If the line representing the higher value crosses above the other line, it indicates overbought conditions and if the lower line crosses below the upper line, then we have oversold conditions. When both lines cross at the same time, this signals a change in trend. The MACD oscillator can be used as a tool to help determine when to buy or sell stocks. Trading stocks using various momentum strategies is no different from trading other instruments using this technical indicator. Momentum stock trading involves choosing the indicator period for each stock individually, depending on its volatility and the nature of price movements. Another variant of an exit signal is to close a position when there is a divergence between the price chart and the indicator line.

Your sell order will be placed at a predetermined level above the current price so that when it is triggered, you exit your position with a profit. Since trading currencies that move in the opposite direction can lead to zero pairs, it is not a recommended option. This indicator is used by the traders to manage the risks that come with buying positions of the same currency pairs. Donchian Channels are three lines that are generated by MA calculations that comprise form an indicator created by upper and lower bands around a median band.

Apart from being excellent https://1investing.in/ indicators, MACD is used by the technical trader for trading stocks, bonds, and commodities as well. Relative Strength Index or RSI is another best Forex indicator for technical analysis out there that ranges from 0 to 100. These technical indicators indicate when the price action in the market is likely to reverse.

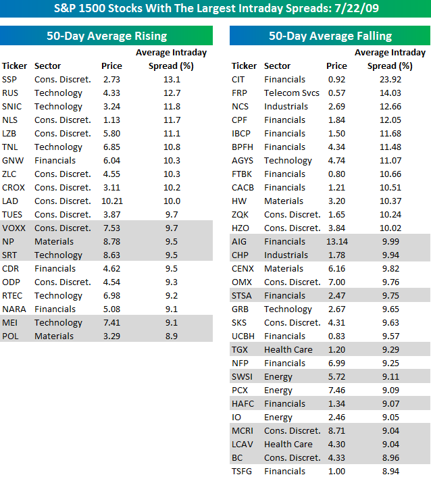

Such indicators give valuable information on price signals, the momentum of the market, market trends, assessing the volume of popular securities etc. With the growing popularity of intraday trading indicators, it is important to simplify our understanding of them and learn how we can effectively use them to our advantage. Intraday traders use Technical Analysis to identify patterns in price movements on the charts in various timeframes and take positions accordingly. Multiple Standard Momentum The momentum indicator is a technical indicator that measures the speed and strength of the price movement of a financial asset. This indicator is used to identify the underlying strength of a trend and predict potential changes in price direction. The calculation of the momentum indicator is based on the difference between the…

- One of the most common is the moving average indicator, which helps traders determine if a stock or commodity is trending up or down.

- The moving average is one of the best forex indicators that every trader should know.

- This intraday tip can help traders create strategies in intraday trading.

- The most popular fall into three categories, as explained in the following momentum indicators list.

- What are Pivot Points in ForexPivot Points help traders identify market reversals.

Forex traders fetch all kinds of stratagems and timelines to the table when analysing forex charts. The chart patterns and forex indicators can be used to estimate trading opportunities depending on both personal trading preferences and the price activities fluctuating on the forex charts. Momentum traders believe that prices that have been moving in one direction over some time will continue to move in that direction for a limited period. They believe that buying high price momentum stocks and selling low price momentum stocks will result in portfolio outperformance. The Bands show that the prices in relation to the average are subject to rapid changes, and traders can expect price movements to be anywhere in between the two bands. Forex traders can use the bands to place sell orders at the upper band limit and buy orders at the lower band limit.